A national poll from NeighborWorks America found nearly half of the taxpayers across the country expect to use their 2017 tax refund to strengthen their financial situation by either paying off debt or saving for the future. Financial capability counselors from White Earth Investment Initiative and Midwest Minnesota Community Development Corporation are ready to help you make the best decision possible when it comes to completing tax forms, saving and managing debt.

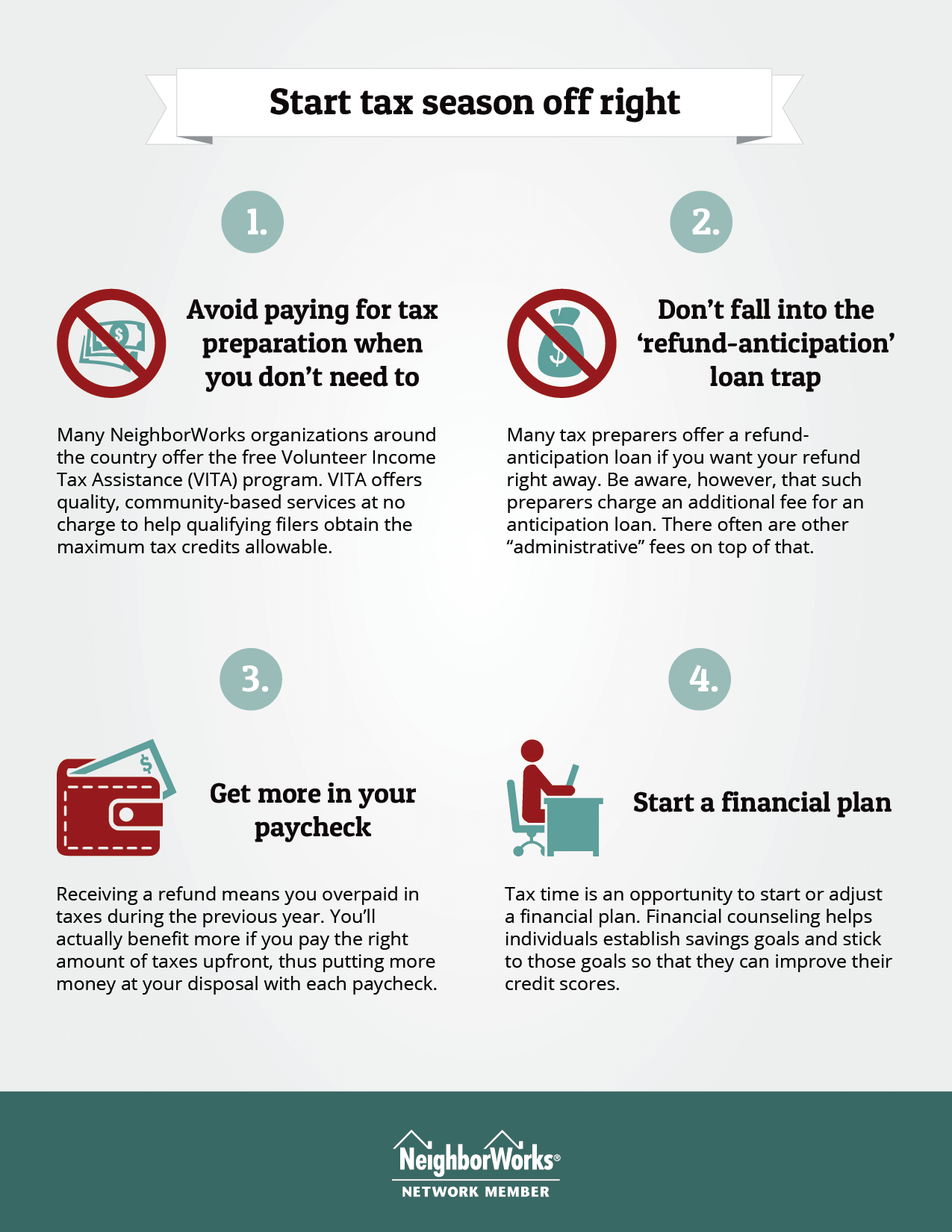

- If you’re using a tax preparation professional to complete your form, seek a referral from friends and co-workers. Not all tax preparers offer the same degree of service, and fees can vary widely.

- Consider having your tax documents prepared by the White Earth Investment Initiative. We are affiliated with the Volunteer Income Tax Assistance (VITA) program. VITA tax preparers receive training and certification by the U.S. Treasury department. Taxpayers who want to work with a VITA consultant need to meet income and family size requirements. The staff at White Earth Investment Initiative and MMCDC are available to help customers determine if they’re eligible for the VITA program.

- Think about using a tax refund to save for retirement. A majority of Americans enter retirement without enough money to maintain their lifestyle. Saving early and consistently will help you reach your goals.

- Be wary of tax preparers that urge you to receive a tax refund anticipation loan. These loans often are very high cost, and while they may put money immediately into your pocket, electronic filing is easy and refunds are available to you in just days.

- Consider establishing an emergency savings account. Nearly one out of three adults or more than 70 million people in America don’t have an emergency savings account. About 47 percent of Americans with a savings account say that their savings would last less than one month. If you don’t have an emergency savings account starting one with a portion of your tax refund is a great first step.

- Understand the differences between savings accounts. White Earth Investment Initiative and MMCDC offer financial capability counseling that can help you select the savings account that is right for you.

- When paying off debt, recognize that not all debt is the same. Home mortgage debt and credit card debt are very different. A financial capability counselor from White Earth Investment Initiative and MMCDC can help you prepare and follow-through on the best way to reduce debt.

White Earth Investment Initiative is an affiliate of MMCDC, a member of the NeighborWorks network.